|

I’d like to explore inspired action in financial trading. I have been trying index futures day-trading (mostly unsuccessfully) for a long time now. The 30-day vortex challenge has given me hope. There is one specific area I’d like to discuss and that is inspired action when taking a trade. My problem has always been that I am always hurrying to take a trade, and I therefore take too many bad trades. I am beginning to think if I can implement a system whereby I only take trades which are inspired action, then I should be profitable. I’d like to hear from anyone (especially @Stingray) if they can offer any insight. The problem with intra-day trading is that there isn’t much time to decide if a trade is inspired action or not. The market isn’t going to wait for you. I have read what @Stingray says here about inspired action. The problem that still remains is the little time that is available to decide. Now that I am into the 30-day vortex challenge, I'd like to feel good at all times and the market to offer me trade, rather than me go and fight it. Any help would be greatly appreciated. |

|

I'm sure @Stingray will be along to share his wisdom with you shortly. I just wanted to pick up on you saying 'the market isn't going to wait for you'. You need to clean that vibration up because the market IS going to wait for you. It's your personal market in your personal reality. There is no reality outside of yourself. So, to make a trade, you need to see the solution side of the subject not the problem side of it. The solution side says the market will do whatever you want if you're in the vortex on the subject of the market. Get yourself to KNOWING all your trades are hits and then make trades. The problem side of the subject has all kinds of reasons (resistance) why the trades won't be successful i.e: 'the market isn't going to wait for you'. |

Intra-day is always going to be stressful. It's the nature of the beast that it will constantly tempt you into overtrading and I don't see how you could make it otherwise. If you have the financial resources, I would recommend moving up to trading higher timeframes - hourly, daily, weekly charts etc. Obviously it would require placing wider stops (and more patience) but it would give you more time to get into a better-feeling place before placing the trades. And if you did your decision-making outside of market trading hours, you wouldn't fall foul of sudden impulse trades. Here's a chat I had with Abraham about a decade ago regarding stockmarket trading. See if it gives you any insights. https://www.youtube.com/watch?v=GtNhpL1GpIo ...oh, and it was THREE people controlling the stockmarket in case you couldn't hear it clearly :) @Stingray Thank you for sharing your chat with Abe. In case anyone wants to know who those three people are... after doing intense research on this topic, I came to the following conclusion: 1. David Beckham 2. Dalai Lama 3. Krusty the Clown

(20 Oct '14, 19:25)

releaser99

A fair few years ago I called a particular spirit and asked about the markets and how to best trade in them and got a similar response (that it was all very deliberately manipulated by a few who are very adept at understanding and manipulating people's fear and greed). I wasn't properly developed enough to carry on a full conversation with the spirit at the time, but consequently was led to a number of books such as one called "How To Make The Stock Market Make Money For You" by Ted Warren...

(21 Oct '14, 00:20)

Liam

which does quite a good job at (simply) explaining how the manipulation is overall carried out. Another group of books I was led to (after the more simple work of Warren) were those by William Gann who also mentioned the manipulation but goes into things in a bit more of a detailed and complicated manner and whose methods were based on astrology, (sacred) geometry and other mathematics.

(21 Oct '14, 00:24)

Liam

Though I still can't hear three people in that recording for some reason and I never would have expected so few. Currencies, futures, stocks (and NOT just the US stocks, while I haven't looked at so many Asian stocks many of them show signs of manipulation too though I feel the game may be played a bit differently with them and haven't tried yet) are all manipulated, if that's true I'd have to imagine they are not public figures at all and have more money than anyone in the forbes top lists.

(21 Oct '14, 00:31)

Liam

1

@Liam - "Though I still can't hear three people in that recording" - You can just about hear it on high volume. They tried to mouth it silently to me but the microphone still picked it up. I was sitting in the "hot seat" close in front of Esther, much closer than people normally are these days because of the cameras they now use. It was as though they understood the enormity of what they were revealing - and didn't want to - but had to respect my desire for an answer. I'm still not sure...

(21 Oct '14, 02:24)

Stingray

@Liam - ...what to make of the response and never really followed it up. But, during that session, they really kept pushing the idea that to be successful you had to tune into what "those who move the markets know" rather than relying on technical/fundamental analysis so the manipulation comment clearly wasn't a channelling hiccup. So with the Warren/Gann material, you were guided to pay attention to their manipulation comments alone, rather than their trading systems?

(21 Oct '14, 02:31)

Stingray

@cod2 - "is that a Yorkshire accent" - No, it isn't. It's just how Krusty The Clown sounds to Earth-people when projecting into this physical dimension.

(21 Oct '14, 02:33)

Stingray

@Stingray Ah yes. Heard it this time, third times the charm. :) That is all very interesting to me. Well, Warren's whole method is based on the markets being manipulated and figuring out where the market makers currently are in their plan so there's no separation there. His stuff isn't a trading system though, it ranges over a period anywhere from 6 months - 10+ years (rare but I've seen it in past charts) if you stick to what he says...and he does terrible things from a traders perspective..

(21 Oct '14, 06:24)

Liam

such as recommending you buy more stock if the price decreases even more. Despite that, in his case I would say I was heavily guided to look at his "system" (and it has proved profitable). Gann is something else entirely and initially I only paid attention to his mentions of manipulation (which he actually claimed he didn't think happened anymore - as of 1940s - but seemed to hint otherwise elsewhere). His system is too complicated and I favor simplicity...but he keeps coming back up.

(21 Oct '14, 06:45)

Liam

So I actually feel like I was (and still am) guided to somehow combine the two - primarily the idea of deliberate manipulation along with astrological timings. Afaik, Gann never outright mentioned astrology (or revealed his whole system) but hinted heavily that his key was based on astrological cycles and knowledge found in the bible. But I'm still at the stage of exploring astrology and its relation to the markets (or if there is one) let alone combining the two. :)

(21 Oct '14, 06:51)

Liam

@Liam - "the idea of deliberate manipulation along with astrological timings" - I think you are on the right lines there. This is actually how I believe the manipulators can move markets. After that chat with Abraham, I spent a long time studying Delta (itself a psychically channelled system) and its derivatives like Market Matrix. I think it's a virtual impossibility that solid market trends can be bucked because...

(21 Oct '14, 07:12)

Stingray

@Liam - ...the financial resources and conspiracy-levels required are just not realistic. But someone "clear-minded" (as Abraham put it) would be able to pick up on (or sense) natural major points of instability/vulnerability within a market (astrologically-linked) and be able to force a significant trend change for personal gain with relative ease. Abraham's phrasing implies that it is their knowledge of how the markets work linked in with clear intent that gives them the power.

(21 Oct '14, 07:18)

Stingray

@Stingray Yeah I agree about how much financial resources and cover up that would probably be needed otherwise. Good to see I'm not the only one who has been "led" that way and thanks for the link, clicking around there led to another rabbit whole for me to explore sometime.

(25 Oct '14, 16:48)

Liam

showing 2 of 15

show 13 more comments

|

|

Hmmm..this is a good one.

If you're in perfect alignment everything will wait for you or do whatever it is you want for you. What's important is your knowledge (: belief system :) that you have acquired over the years in the context of financial trading. If you've been reading all those great (: I admit I used to enjoy them and believe them :) business and financial texts you probably have more opposing ideas in your vibration than you are aware of. In reality, it is possible to manifest anything that you are in alignment with. The key is the ALIGNMENT. Frankly, if you are in a "hurry" there is mostly likely some kind of negativity involved and it's only you who can pin it down. Begin, by running an affirmation like "I have all the time in the world" through your head as often as you can. The idea is not induce such knowledge (: although that happens often :) through the affirmation but more to get your mind turning slightly in this direction and also it might bring out opposing thoughts which might reveal ideas (: desires :) you hold that run contrary to your desire to relax. Another thing you can do, is begin to relax anytime you are not trading: relax in the meeting room, during the coffee break, when driving (: or take the public transport where you can focus on your Self :), relax when eating. That way you can build the habit of "chilling" out into your system without getting into direct conflict with your trading although do try to find something to feel good about while trading. Focus on feeling good rather than trying to avoid hurrying. At tempting avoid magnifies what you are trying to avoid. Merely gently try to guide the mind (: even mechanically to begin with :) in a more pleasing direction. When going to sleep, when you wake up or anytime you can (: assuming your feeling at least marginally good :) imagine scenarios that imply you are relaxed i.e. see friends telling you how relaxed you are, imagine them asking you for your secret to success, imagine them being amazed at how easily and coolly and relaxed you have been for so many years while still acing the market :) and so on. Anything that gets the mind moving in that direction. Also, if you could just gently direct yourself into the "feeling better" (: and then better and better :) zone then all your circumstances will rally to that feeling. If you're faced with circumstances that seem to put an illusion of "pressure" on you, then you're generating it from within through your vibration. Brilliant answer, Harsha.

(21 Oct '14, 06:01)

cod2

Thanks. Oh, and a very good practice is to meditate daily as often as you can. Just pick something nice to focus on (: anything that generates pleasant emotion or even a dot will do :) and run your mantra "I am relaxed" (: or even just "I AM" :) through your mind while focusing on your breathing. Do it in 10-15 minutes bursts whenever you can find the time. In the long run this will produce huge benefits.

(21 Oct '14, 06:17)

harsha

I have joined Stingray's 30-day vortex challenge, so I am expecting to see major changes in me by the time I am past the 15th consecutive day.

(21 Oct '14, 06:28)

cod2

showing 2 of 3

show 1 more comments

|

|

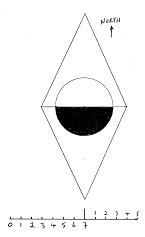

Taking inspired action in stock exchange day-trading is all about making empowered decisions and feeling comfortable and certain that the choice you've made takes you closer to your goals, whatever the time frame be it just a few seconds, a minute, an hour, a day, a week, a year of even 10 years. Indecision holds you back it's a place of disempowerment, each now moment is precious so making a decision and moving forward with it is the first essential. Nothing is ever fixed forever, everything is moving energy and the stock exchange is a good example of this. Whatever decision you choose to act upon can always be readjusted along the way. Stock market values either rise or fall and in a highly volatile market the difference between the highs and lows can be significant even in just one day, so knowing exactly what to do at any given moment is very important. The best way to feel confident and sure of what you're doing is to use your internal "yes" "no" barometer, your emotional feed-back mechanism or whatever you like to name it. I like to think of it as an internal compass that let's me know in which direction I'm headed, the more I learn to notice it the better my decisions. It's a mechanism that works outside time thus in all time frames. In practice for starters that means for day trading preparing your trades the evening before. Just sit quietly and travel forwards in your mind to the following evening and ask yourself "is there an increase in the value of this stock?" "is there a decrease in the value of this stock?" Trust what's going on inside you and you'll know what to do. Many stocks can be traded in both directions so you can make money whether the stock value rises or falls, and once you know how to do that you're really "in the money" :) Here's a little something extra to hone your intuition if you're that way inclined, it's a graph used in conjuction with a pendulum

|

If you are seeing this message then the Inward Quest system has noticed that your web browser is behaving in an unusual way and is now blocking your active participation in this site for security reasons. As a result, among other things, you may find that you are unable to answer any questions or leave any comments. Unusual browser behavior is often caused by add-ons (ad-blocking, privacy etc) that interfere with the operation of our website. If you have installed these kinds of add-ons, we suggest you disable them for this website